24+ Pay down debt calculator

Fixed rates range from 3. Focus on paying down the debt with the highest interest rate.

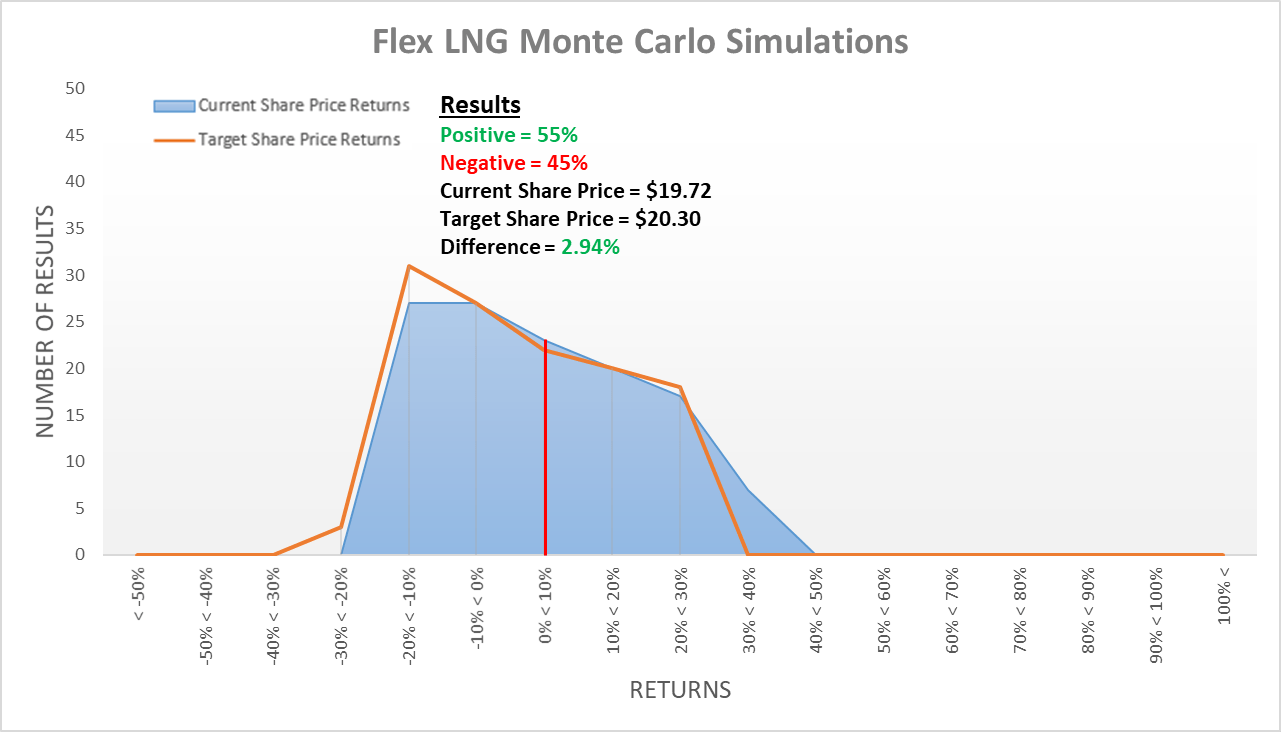

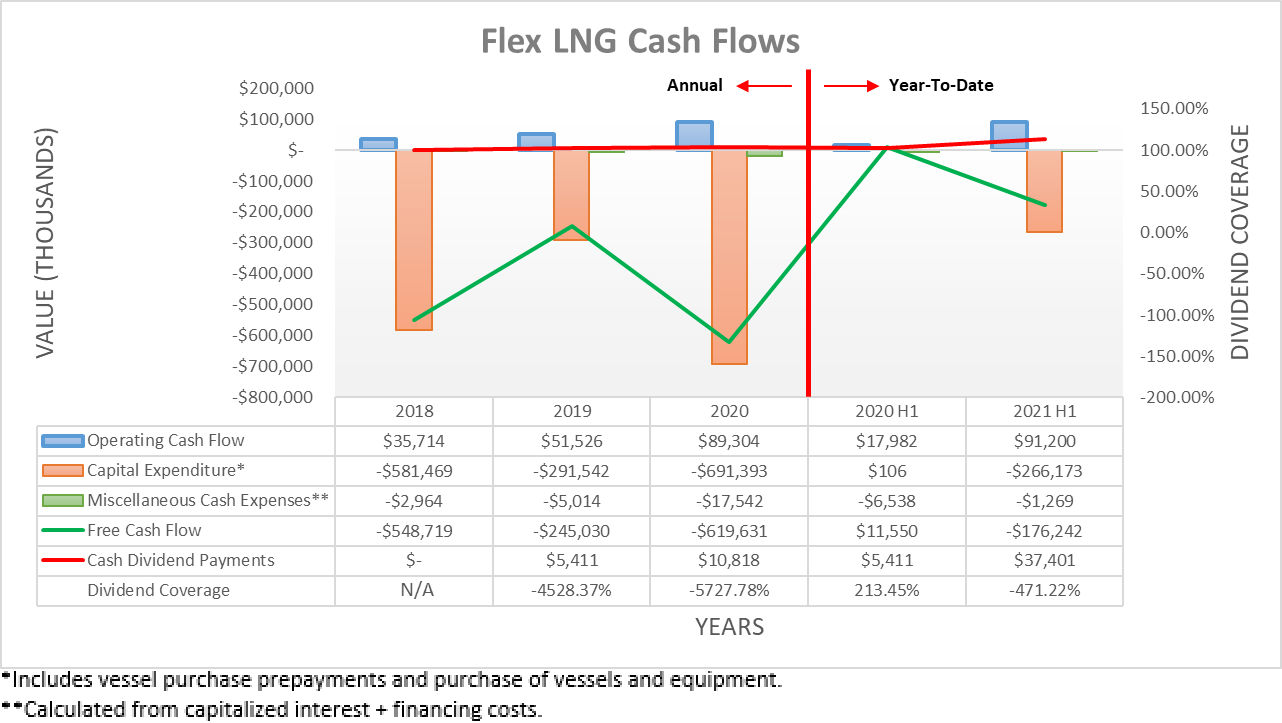

Flex Lng Priced For Boom Time Earnings Significant Risks Nyse Flng Seeking Alpha

3 Debt Snowball Worksheets.

. Before getting yourself in debt its important to leverage a Car Payment Calculator that helps you determine your monthly payment and the time it would take you to pay off your debt. Other revolving lines of credit may also have high interest rates. A low debt ratio will also reduce the likelihood of bankruptcy or the inability state of business to pay its debts resulting in a legal proceeding with its lenders.

Instead the discount is applied to the principal to help pay the loan down faster. The lenders generally finance 90 of the ex-showroom price of the bike. 5 ways to consolidate debt.

Use a Lump Sum to Pay Down Debt. PAYE limits your monthly student loans to 10 of your discretionary income. Use this calculator to compare the numbers and determine how much you can save.

2 The benefits of using the debt snowball method. Some customers might be eligible for 100 funding too. We may be compensated if you click this ad.

This means the minimum possible down payment that you have to pay includes the RTO and insurance charges for the bike. Find out with our Income-Based Repayment Calculator. Then add the 24 digits 1234 and so on up to 24 and your total is 300.

In order to pay off 10000 in credit card debt within 36 months you need to pay 362 per month assuming an APR of 18. Down payment is the difference between the on-road price of the bike and the amount funded by lender. Your credit utilization ratio will help boost your credit score and lower your DTI ratio because you are paying down more debt.

The Debt Collection Process. 1 with an interest rate of 1995 percent and card No. If you pay the car off 12 months early you would pay 38929 of interest.

One option to speed up this process is to use a debt consolidation loan. Our free mortgage calculator gives you an idea of how much you can expect to pay for a mortgage in 2022. Car Payment Calculator - 2022.

Unconventional Ways of Building Improving. For example if you have two credit cards card No. Table of Contents.

1 Debt Snowball Spreadsheets. 22 You can negotiate the interest rates. While you would incur 3039 in interest charges during that time you could avoid much of this extra cost and pay off your debt faster by using a 0 APR balance transfer credit card.

Latest news and advice on mortgage loans and home financing. For 2020 the FICA limit is on the first 137700 of income. Your household monthly income monthly debts credit cards student loans and the amount of available savings for a down payment.

By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender. There are pros and cons to each option and as always youll want to shop around. Check out Moneys debt-to-Income ratio calculator.

By taking the proceeds of a personal loan to pay off credit card debt you can eliminate multiple monthly high-interest card. Mortgage lenders want potential clients to be using roughly a third of their income to pay off debt. Many people find the debt snowball method to be a good way to pay down their debt.

Pay yourself by paying off debt. How the New FICO Credit Scoring System Will Affect You January 29. Typically charge interest rates between 12 and 24 although some.

Freeing up extra cash at the end. Self-employed people pay self-employment taxes which had them paying both halves of the tax. Secrets of Debt Collection.

Fixed rates range from 349 APR to 824 APR excludes 025 Auto Pay discount. 12 with an interest rate of 2499 percent youd focus on paying off No. Variable rates range from 214 APR to 8.

But its a slow process. September 24 2020. Besides a lower debt ratio also serves as a prevention measure in case lenders.

This method allows you to make noticeable progress by paying as much as possible each month toward your smallest balance. For most people high interest debt means credit card debt. Employees and employers typically pay half of the 124 Social Security 145 Medicare benefit each for a total of 153.

See when the loan is paid or written off based on current salary and future salary projections. If you cant postpone the purchase until you can pay cash plan to make a down payment of 1020. Once you run the numbers youll want to choose a method to consolidate your debt.

23 You can customize your snowball plan to suit your needs. Private Student Loans. The interest rate on these debts makes the math simple.

The interest paid the first month is 4167 and it goes down each month until you pay just 182 the final month. Our mortgage payoff calculator can show you how making an extra house payment. Ask a question.

Carbon Collective March 24 2021. Instead the discount is applied to the principal to help pay the loan down faster. 21 This method will build momentum as time goes by.

Multiple loans and lines of credit can make it difficult to pay down debt and get ahead financially. If you have any short-term loans such as payday loans pay down those balances as soon as possible. Skip to main content Top Menu.

Pay Down High-Interest Debt. Means most people with Plan 2 loans are better off waiting for the 30 year write-off period than they. It will most likely able to pay off its due debts on time.

In the meantime make the minimum payment on all your other debts so your accounts remain in good standing. 2 since it has the highest interest rate while still paying the minimum on No. Can Debt Collectors Track You Down on Facebook.

Use our PAYE Calculator to see how PAYE may be able to lower your monthly payments as well as result in forgiveness of your student loans. 2836 are historical mortgage industry standers which are. Calculate your UK student loan repayments with this free student loan repayment calculator.

But some people opt for 15-year loans to pay off debt faster or an adjustable-rate mortgage. Pay Off Debt and Build Wealth. Try this calculator to see how your debt payoff schedule can be optimized by rolling the payments into an effective long-term strategy.

4 How does the snowball method for paying off debts work.

Printable Employee Work Schedule Template Monthly Schedule Template Schedule Calendar Weekly Schedule Template Excel

Flex Lng Priced For Boom Time Earnings Significant Risks Nyse Flng Seeking Alpha

2

2

Kqgrpjst53f Zm

How Long Can You Go Without Sleep Each Night

Financial Report 24 Examples Format Pdf Examples

Sustained Credit Card Borrowing Grodzicki 2021 Journal Of Consumer Affairs Wiley Online Library

Profit Loss Statement Template Excel 11918359 Resumesample Resumefor Profit And Loss Statement Statement Template Profit

Credit Card Payoff Spreadsheets Find Word Templates

Pin On Excel Tips

2

Does Every Hotel Have 24 Hour Reception Services Quora

Workout Progress Chart How To Create A Workout Progress Chart Download This Workout Progress Chart Template Now Chart Templates Fitness Progress

Credit Card Payoff Spreadsheets Find Word Templates

Pocket Size Small Business Kit For Traveler S Notebook Etsy Canada In 2022 Travelers Notebook Business Goal Tracker Pricing Calculator

How To Get Out Of Debt Pay Off Debt Or Save Advance America